On Thursday, ASML, a crucial supplier of equipment for computer chip manufacturers, announced a EUR 12 billion (approximately Rs. 98,380 crore) share buyback program set to run through 2025. In anticipation of an investors’ day on Friday, the company revealed its expectation of reaching a revenue range of EUR 30 billion (approximately Rs. 2,45,600 crore) to EUR 40 billion (approximately Rs. 3,27,550 crore) by 2025, an increase from the earlier estimate of EUR 24 billion (approximately Rs. 1,96,500 crore) to EUR 30 billion.

ASML’s sales in 2021 amounted to EUR 18.6 billion (approximately Rs. 1,52,460 crore). With more orders for its equipment than it can presently fulfill and a predicted decade of growth, ASML is actively proceeding with plans to expand its capacity. Despite near-term uncertainties in the current macro environment, the company remains optimistic about the long-term outlook, anticipating robust growth in demand and capacity.

Following the announcement, ASML’s shares surged, closing 9.7 percent higher at EUR 544.20 (approximately Rs. 44,600) in Amsterdam. The company envisions sustained sales growth, setting a sales target of EUR 44 billion (approximately Rs. 3,60,500 crore) to EUR 60 billion (approximately Rs. 4,91,700 crore) by 2030.

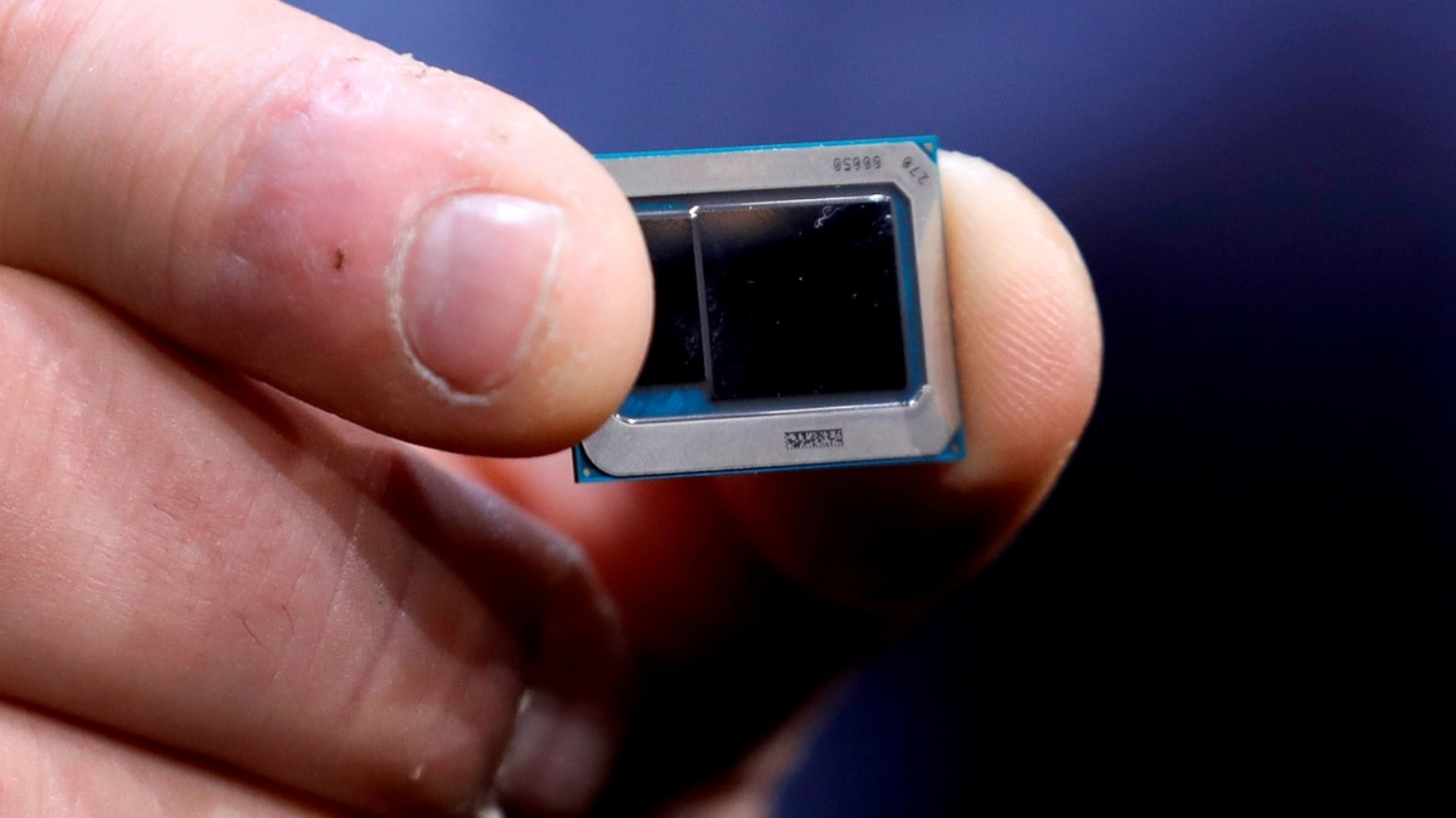

ASML, known for dominating the market for lithography systems crucial in mapping out semiconductor circuitry, foresees an expansion in the production of its flagship EUV machines. Priced at about EUR 200 million (approximately Rs. 1,600 crore) each, the company aims to increase the annual production of these machines from the current 60 to 90 by 2026. Key customers of ASML include Taiwan’s TSMC, South Korea’s Samsung and SK Hynix, as well as Intel and Micron Technology in the United States.